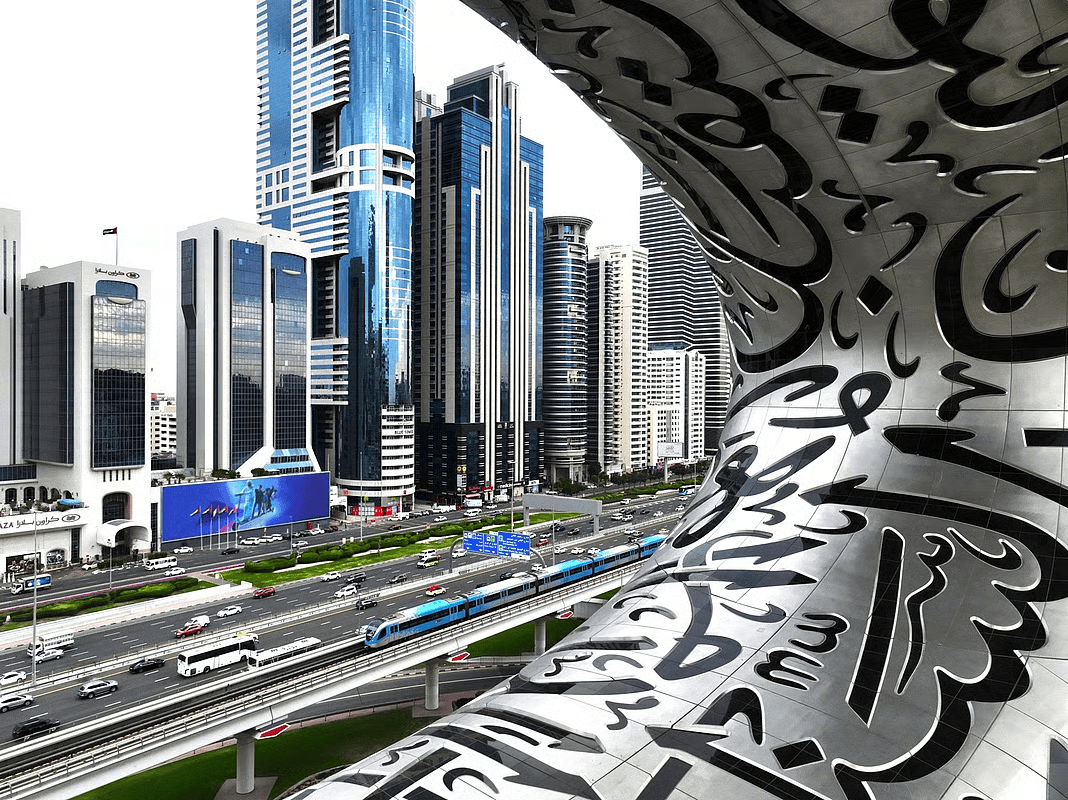

Dubai’s Real Estate Market Records Over 19,000 Transactions Worth $17.62 Billion in November 2025

For investors, end-users, and global high-net-worth individuals (HNWIs), this isn’t just another headline. It’s a crystal-clear signal that Dubai’s property market continues to expand, diversify, and strengthen even in a world filled with economic uncertainty.

Let’s break down what fueled this powerful month, which segments led the surge, and what it all means for the future of Dubai’s real estate landscape.

A Record-Breaking Month That Reinforces Dubai’s Global Appeal

What makes November’s numbers special isn’t just the volume it’s the consistency. Hitting 19,000+ transactions in a single month underscores a market running at full speed across all categories: residential, commercial, off-plan, and secondary resale.

Several factors contributed to this impressive performance:

strong local demand driven by rising population

global HNWIs continuing to relocate to the UAE

developers launching ambitious off-plan projects

high rental prices pushing residents toward ownership

economic confidence boosted by long-term national strategies

Dubai didn’t just break records. It showed the world that its property market is built on solid fundamentals, not speculation.

Off-Plan Sales: The Driving Force Behind the Surge

It’s no surprise that off-plan dominated November’s numbers. Buyers are drawn to off-plan offerings for one simple reason: they offer a chance to buy into Dubai’s future at today’s prices.

What made November extraordinary?

1. New Mega-Launches Were Oversubscribed

Developers rolled out large-scale projects across Dubai South, Dubailand, and waterfront zones and many sold out within hours.

Payment plans as flexible as 60/40, 70/30, or post-handover made these launches especially appealing to:

first-time buyers

investors seeking long-term appreciation

overseas buyers looking for easy entry points

2. Affordable Luxury Is in High Demand

There’s a growing appetite for mid-luxury apartments with premium amenities rooftop pools, co-working spaces, wellness zones, and smart-home features.

Smaller developers also played a major role this month by delivering niche, design-focused communities that resonated with buyers priced out of prime locations.

3. Investor Confidence Is at Peak Levels

Global uncertainty is pushing capital toward stable markets. Dubai’s tax-free environment, transparency, and strong returns continue to attract investors from:

India

Saudi Arabia

China

Europe

Africa

Off-plan remains their preferred entry due to high projected capital gains.

Secondary Market Stays Strong as End-Users Drive Demand

Dubai’s resale market also posted impressive numbers in November, proving that the emirate’s property cycle is not dependent on off-plan alone.

Why is the secondary market thriving?

1. Rising Rents Push Tenants Toward Ownership

With rentals rising across communities some by double digits 55% of tenants now plan to buy within the next year.

Buying a ready unit becomes the smarter financial move for anyone planning to stay long-term.

2. HNWIs Prefer Ready Villas and Waterfront Homes

While off-plan apartments dominate volume, wealthy buyers continue hunting for:

Palm Jumeirah villas

Emirates Hills mansions

Dubai Hills Estate homes

Jumeirah beachfront residences

These properties offer immediate luxury, privacy, and strong rental yields.

3. Corporate Relocation Fuels Commercial Demand

Dubai’s growth as a global business hub has increased demand for ready office spaces in:

Business Bay

DIFC

JLT

Dubai South

Companies expanding their regional headquarters are absorbing high-end commercial inventory faster than anticipated.

Which Communities Led the November 2025 Surge?

Some zones outperformed others due to affordability, lifestyle appeal, or future growth potential.

Dubai South

Fueled by Expo City’s expansion and new master-planned communities, Dubai South continues attracting young families and long-term investors.

JVC & Arjan

These mid-market areas remained leaders in transactions due to:

competitive prices

high yields

fast construction cycles

appeal among first-time buyers

Dubai Hills Estate

Luxury villas and branded residences saw consistent demand, especially from HNWIs relocating from Europe, India, and Saudi Arabia.

Business Bay & Downtown Dubai

Apartments in these zones remain favourites for investors seeking steady rental income and central locations.

Who Is Buying? Global Trends Behind the Numbers

Dubai’s buyers are more international than ever. November’s numbers show strong participation from:

1. Indian Investors

India remains Dubai’s largest international investor group, drawn by:

high rental yields

capital appreciation

ease of ownership

Golden Visa opportunities

2. Saudi Investors

High-net-worth Saudis continue shifting capital into Dubai’s luxury sector, especially waterfront and branded residences.

3. European Wealth Migrants

Buyers from the UK, Germany, France, and Italy seek long-term stability, taxation benefits, and climate-driven lifestyle upgrades.

4. Chinese Investors Return

With eased travel restrictions, Chinese investors re-entered Dubai’s market, focusing on off-plan and hotel apartments.

Dubai’s ability to attract such diverse global demand reinforces its position as one of the most secure and profitable real estate environments in the world.

Why Dubai Continues to Outperform Global Markets

The November record proves that Dubai is not just growing it’s maturing into a stable, globally respected real estate economy.

Key reasons behind this unstoppable momentum:

population growth surpassing 3.7 million

smart government policies encouraging investment

long-term residency visas creating security

world-class infrastructure upgrades

job creation across finance, tech, tourism, and logistics

developer innovation pushing new lifestyle concepts

While many global cities face stagnation, Dubai continues rising backed by real demand, not speculation.

What November’s Record Means for 2026

Looking ahead, the market is poised for steady growth rather than sharp spikes.

This is healthy and exactly what seasoned investors want.

Expect to see:

sustainable price appreciation

more mega-developments

increased interest from global HNWIs

strong rental market performance

greater competition in mid-market communities

expansion of suburban luxury zones

Dubai’s real estate trajectory remains upward, disciplined, and opportunity-rich.

Conclusion

With more than 19,000 transactions worth $17.62 billion, November 2025 wasn’t just a strong month it was a historic milestone that reflects the confidence, maturity, and global magnetism of Dubai’s real estate market.

Across off-plan launches, ready villas, commercial spaces, and mid-range apartments, demand continues to deepen and diversify. And with international investors increasingly calling Dubai their long-term home, the momentum is unlikely to slow down anytime soon.

If you're looking to invest in a market backed by real demand, strong returns, and global credibility, Dubai is the place to be and Harpreet Real Estate LLC is here to guide you.

Whether you're exploring off-plan projects, luxury homes, or high-yield apartments, our team helps you make smart, strategic, and secure decisions.

Reach out today and unlock Dubai’s most rewarding real estate opportunities with trusted experts by your side.

Leave a Reply

Comments