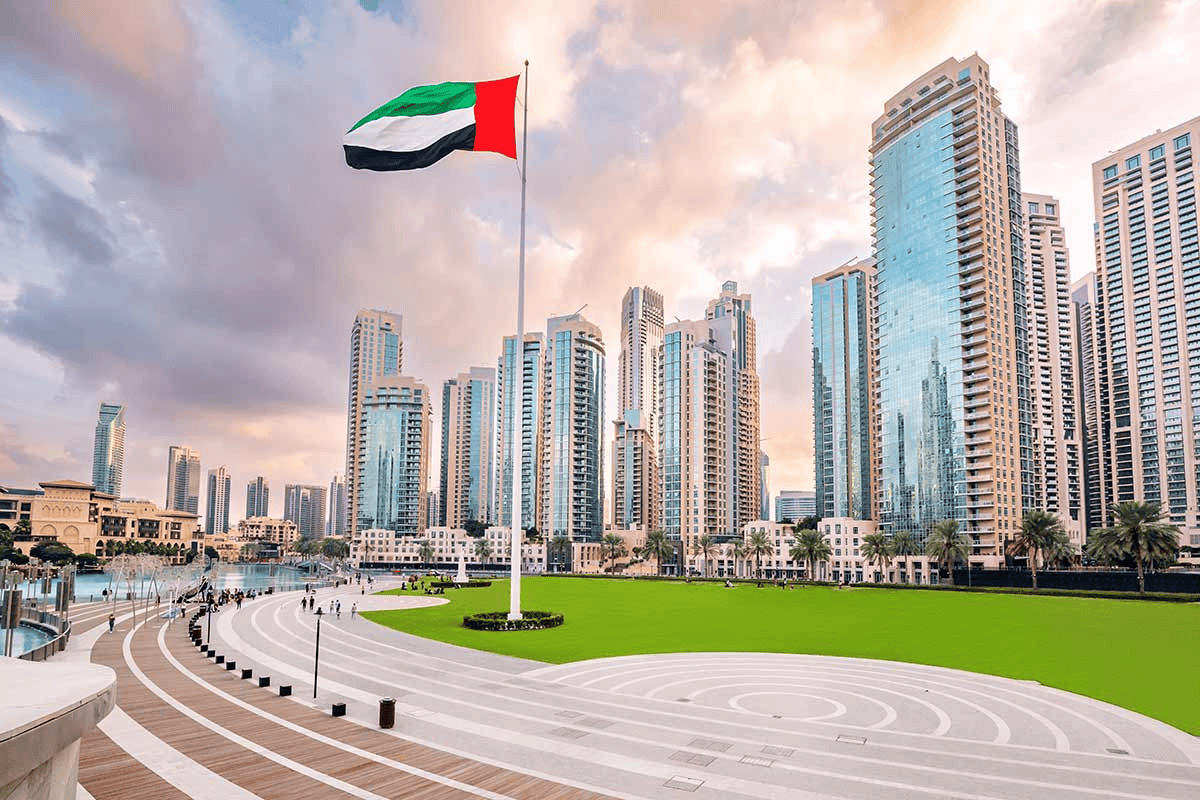

UAE Real Estate Sector to Hit $759bn by 2029 Amid Dubai and Abu Dhabi Property Boom

In 2024 alone, Dubai’s property market shattered records, with AED 153.7 billion worth of sales recorded in Q2, marking the strongest quarter in its history. Abu Dhabi, meanwhile, is catching up fast with its own luxury and off-plan boom. Together, these two cities are positioning the UAE as one of the most dynamic real estate hubs on the planet.

Now comes an even bolder projection: by 2029, the UAE real estate sector is expected to reach $759 billion in value. That’s not just a number it’s a reflection of long-term faith in the country’s growth, policies, and unmatched lifestyle offering.

At Harpreet Real Estate LLC, we’ve had the privilege of watching this story unfold up close. Let’s take a deeper look at what’s driving this extraordinary surge, who the key players are, and what the future holds.

UAE real estate is projected to reach $759bn by 2029, driven by Dubai’s AED153.7bn Q2 sales surge, Abu Dhabi growth, and strong demand for off-plan and luxury homes.

The Role of HNW Buyers: Who’s Fueling the Demand?

The most noticeable shift in the UAE property market has been the rise of High-Net-Worth Individuals (HNWIs) as dominant buyers. Unlike past cycles, where mid-level investors dominated, today’s demand is being written by billionaires, global entrepreneurs, and wealthy families.

Saudi Investors Leading the Pack

Nearly 96% of Saudi HNWIs surveyed have shown interest in Dubai real estate, with many already acquiring second homes or flagship investments in Palm Jumeirah, Emirates Hills, and Business Bay. For them, Dubai is an extension of home a city with cultural proximity, luxury offerings, and unmatched convenience.

Indian Buyers Close Behind

For Indian investors, the appeal is both emotional and financial. With 86% of Indian HNWIs expressing interest in Dubai property, the city has become a natural choice for second homes, family offices, and portfolio diversification. Easy flight access, tax-free ownership, and the Golden Visa scheme make Dubai particularly attractive to this demographic.

Global Wealth Migration

Europeans, Russians, and Chinese investors are also steadily entering the UAE market. Many are driven by geopolitical uncertainty at home and see the UAE as a safe haven for both lifestyle and wealth preservation.

These trends have elevated demand for ultra-luxury properties, branded residences, and prime off-plan projects, where units often sell out within days of launch.

Why the UAE? The Unique Mix Driving Growth

The real estate boom isn’t just about glitzy skyscrapers. The UAE has created a perfect storm of policies, infrastructure, and lifestyle factors that make it an international magnet for investors.

1. Golden Visa Advantage

For many investors, property is not just about returns it’s about residency. The 10-year Golden Visa, granted on purchases above AED 2 million, has turned Dubai and Abu Dhabi properties into gateways for long-term living and global mobility.

2. Tax-Free Incentives

No income tax, no capital gains tax, and relatively low transaction fees set the UAE apart from mature markets like London or New York. For HNWIs, the savings can run into millions over time.

3. Luxury Lifestyle That Sells Itself

Dubai offers beach clubs, Michelin-starred restaurants, world-class schools, and healthcare, while Abu Dhabi delivers cultural prestige through attractions like the Louvre and Guggenheim. For buyers, the decision isn’t just financial it’s about living well.

4. Strong Economic Fundamentals

The UAE government’s diversification strategy has pushed growth in technology, finance, and tourism. Real estate is thriving not in isolation but as part of a broader, well-balanced economic vision.

5. Expo 2020 Legacy & Beyond

Expo 2020 accelerated infrastructure growth, while mega-projects like Dubai Creek Harbour, Mohammed Bin Rashid City, and Saadiyat Grove in Abu Dhabi continue to draw global attention.

6. Safety and Stability

In a world of uncertainty, the UAE stands out as a politically stable, safe, and globally connected hub. The dirham’s peg to the U.S. dollar ensures currency stability for international investors.

Spotlight on Dubai: The Luxury Capital of the Middle East

Dubai continues to set the pace. The Palm Jumeirah remains the crown jewel, with villas selling for upwards of $30 million, while Downtown and Business Bay have seen record apartment sales. Interestingly, Business Bay recorded a $12 million apartment deal recently, signaling that luxury demand is spreading beyond traditional prime areas.

Off-plan properties are another hot ticket. Developers like Emaar, Sobha, and Damac are reporting sellouts within hours of launch. The appeal? Flexible payment plans, rising values, and entry into some of the city’s most ambitious projects.

Abu Dhabi: The Emerging Luxury Contender

Often overshadowed by Dubai, Abu Dhabi is stepping into the spotlight. With Saadiyat Island developments, Yas Bay luxury homes, and Reem Island towers, the capital is attracting both regional and international HNWIs.

The government’s commitment to sustainable, culture-driven developments think green master plans and world-class museums gives Abu Dhabi a unique edge. Investors increasingly see it as a quieter, more sophisticated alternative to Dubai, without compromising on luxury.

Branded Residences and the Ultra-Luxury Wave

Another unmistakable trend is the rise of branded residences homes tied to iconic names like Armani, Bulgari, and Dorchester Collection. These aren’t just properties; they’re lifestyle statements.

For HNWIs, branded residences offer:

Guaranteed design and service standards.

Strong resale values.

Exclusive communities with hotel-like amenities.

This niche segment is growing so fast that analysts expect branded homes in Dubai to account for a major share of prime property transactions by 2026.

The Road Ahead: Where Is the Market Headed?

The big question: is this momentum sustainable?

Analysts forecast continued growth, though at a measured pace. The UAE real estate market is projected to hit $759 billion by 2029, underpinned by:

Population growth: Dubai alone welcomed over 100,000 new residents last year.

Global investor confidence: Long-term visas and favourable tax regimes keep interest strong.

Ongoing demand for luxury: Ultra-luxury and waterfront projects continue to outpace supply.

Diversified economy: Real estate isn’t carrying growth alone it’s part of a larger ecosystem.

While mid-tier properties may experience occasional corrections, the luxury and HNW-driven market looks robust for the foreseeable future.

What This Means for Global Investors

For international investors, the UAE offers a mix few markets can match:

High ROI potential compared to established luxury cities.

Residency and lifestyle perks that add non-financial value.

Strong governance and economic vision ensuring long-term stability.

Whether it’s a penthouse on the Palm, a waterfront villa in Abu Dhabi, or an off-plan apartment in Creek Harbour, opportunities remain diverse and compelling.

A Word from Harpreet Real Estate LLC

At Harpreet Real Estate LLC, the Dubai arm of Property Gallery, we’ve built our reputation on credibility, honesty, and loyalty. With over 300,000 followers worldwide, we’ve earned the trust of clients ranging from first-time investors to global family offices.

Our role isn’t just to sell property—it’s to guide clients with transparent advice, market insights, and opportunities aligned with their long-term goals. Whether you’re exploring luxury investments in Dubai, emerging hotspots in Abu Dhabi, or the latest off-plan launches, our team is here to support your journey.

Conclusion: A Future Written in Stone, Steel, and Vision

The UAE’s real estate story is one of ambition, resilience, and global appeal. From Dubai’s record-breaking AED 153.7 billion Q2 sales to Abu Dhabi’s rise as a cultural and luxury hub, the numbers tell a story of momentum that shows no signs of slowing.

By 2029, with a market projected at $759 billion, the UAE is not just participating in global real estate it’s shaping it.

For investors, the opportunity is clear: this is a market that balances financial returns with lifestyle rewards, security, and long-term growth.

At Harpreet Real Estate LLC, we invite you to explore what the future of UAE real estate holds and perhaps, to make it part of your own future.

Leave a Reply

Comments